Loan

Programs

Loans That Fit Your Needs

Construction Loans

Looking to build a home? Then a construction loan may be a good fit. Work with your realtor to find the perfect property and your builder to construct your dream home. Construction loans enable your builder to draw funds at different stages of construction so they don’t carry the burden of funding the whole project until completion. Once the construction is done the loan is replaced with standard convention financing.

Home Equity Loans

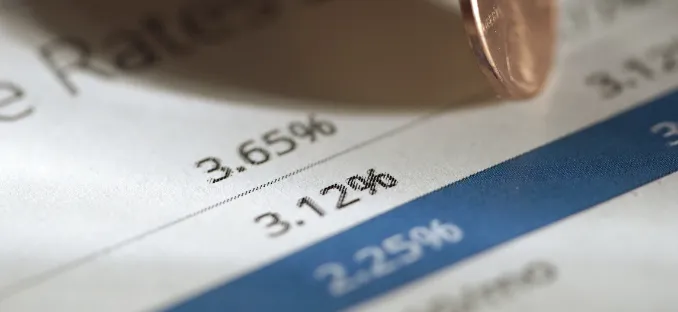

A home equity loan allows you to borrow against the value you've built in your property over time. It is a secure loan with your home serving as collateral, providing lenders with confidence and offering borrowers favorable interest rates. Whether you want to renovate your house, consolidate debt, pay for education expenses, or fund a business venture, a home equity loan can be an excellent solution.

Conventional Fixed Rate Mortgages (FRM)

Conventional Loans fall within the requirements set by Freddie Mac and Fannie Mae, and aren’t guaranteed/insured by the government. They typically require a minimum down payment of 3 to 5 percent, but those who put a minimum of 20 percent down won’t be required to pay for mortgage insurance. Those who qualify for Conventional Loans are in good financial standing.

USDA Loans

If you are looking to purchase real estate outside of a major city, then a USDA loan may be right for you. These government-insured loans do not require down payments and have 100 percent financing**. Various factors come into play when qualifying for a USDA loan, including credit history, income, the amount of dependents, and more. Qualifying Factors May Apply.

Jumbo Loans

Jumbo Loans go above the conforming loan limit set in the county in which you wish to purchase real estate. The loan limits can vary across counties. These loans come in fixed rate or adjustable rate options, can go over the confirming limit up to $3 million, and typically require larger down payments and cash reserves.

Oregon Bond Program

This program is designed to expand opportunities for homeownership in Oregon for first-time buyers and low-to-moderate income individuals. The state will pay for a failed mortgage payment, and when the home is sold those funds must be either be fully or partially paid back to the state. A variety of factors determine the penalty amount.

FHA Mortgage Loans

The Federal Housing Administration insures these loans and they were designed to help consumers purchase homes by offering more flexible requirements. That includes smaller down payments, lower credit scores and higher debt-to-income ratios.

Reverse Mortgage Loans*

This loan is for those who are at least 62 years of age. It helps people tap into their equity to pull out money for things like retirement funding, medical bills, home repairs, and more. Those who get a reverse mortgage can obtain the money through monthly payments, a line of credit, or one large payment. House payments are not required on this program; however borrowers are responsible for paying property taxes and home owners insurance.

VA Mortgage Loans

Veterans, active duty, national guard and surviving spouses can benefit from this loan that is insured by the U.S. Department of Veterans Affairs. VA Loans offer 100% financing meaning no down payment requirements. As part of the Veterans benefit no mortgage insurance is required and the VA funding fee can be financed into the loan.

Renovation Loans

If you want to purchase real estate that needs a little TLC to get it to where you want it to be, a Renovation Loan may be ideal. The loan amount is determined by the assessed value of the property with the repairs to be made being given consideration.

Specialty Loans

Eastbank offers several unique loan products that aren’t offered by all mortgage companies. These include Asset Loans, Low credit score programs, Specialty loans for teachers, police and firemen. Also special loan products for physicians.

Buyers With Blemished Credit Histories (FHA)

The Federal Housing Administration insures these loans and they were designed to help consumers purchase homes by offering more flexible requirements. That includes smaller down payments, lower credit scores and higher debt-to-income ratios.

*Reverse mortgages are loans offered to homeowners who are 62 or older who have equity in their homes. The loan

programs allow borrowers to defer payment on the loans until they pass away, sell the home, or move out.

Homeowners, however, remain responsible for the payment of taxes, insurance, maintenance, and other items.

Nonpayment of these items can lead to a default under the loan terms and ultimate loss of the home. FHA insured

reverse mortgages have an up front and ongoing cost; ask your loan officer for details. These materials are not from,

nor approved by HUD, FHA, or any governing agency.

Contact Info

Address: 10121 SE Sunnyside Rd. Ste. 300

Clackamas, OR 97015

503.496.5178

michelle@eastbankmtg.com |

NMLS #370067

Branch NMLS #1761504

Licensed in Oregon, Washington, California, Arizona, Indiana, Texas, and Florida

AZ BK 0906702

Licensed by the Dept of Financial Protection and Innovation under the CRMLA

Licensed under the Oregon Consumer Finance Act

Texas Disclosure Notice-

https://www.apmortgage.com/state-license-info

Licensed in AZ, CA, FL, ID, IN, OR, TX, WA

Not Available in New York

a Division of American Pacific Mortgage Corporation NMLS #1850

©2023 American Pacific Mortgage Corporation. All information contained herein is for informational purposes only and, while every effort has been made to ensure accuracy, no guarantee is expressed or implied. Any programs shown do not demonstrate all options or pricing structures. Rates, terms, programs and underwriting policies subject to change without notice. This is not an offer to extend credit or a commitment to lend. All loans subject to underwriting approval. Some products may not be available in all states and restrictions apply. Equal Housing Opportunity.

© Copyright 2023-2025. Eastbank Mortgage. All rights reserved.